20+ Borrow 100k mortgage

Jumbo loans can also be fixed rate mortgages or adjustable rate mortgages and can vary in their term length which means these loans can also be customized to better fit each consumers. 100K salary and great credit buys a home above.

Game Of Loans How To Get Rid Of Student Loans And Debt

PMI is usually included into your monthly mortgage payments costing between 05 1 of your loan amount annually.

. LPC for a 400000 property with a 5 deposit is 1425. The most basic system is to use an income multiple as a rule of thumbThe reason income multiples are used is that looking at your mortgage to earnings ratio gives lenders a straightforward window into what you could be able to afford. You can borrow between 100 and 15000 as soon as tomorrow.

Rates as of Sep 09 2022 ET. You could potentially take out 100k cash and your new loan amount would be 300000. The report analysed every suburb in Australia to find property markets suitable for investors with a deposit up to 100000 ready to go.

Rates surge past 6 a 14-year high. So if your home is worth 250000 and you owe 150000 on your mortgage you have 100000 in home equity. 8 remote jobs that pay at least 20 per hour.

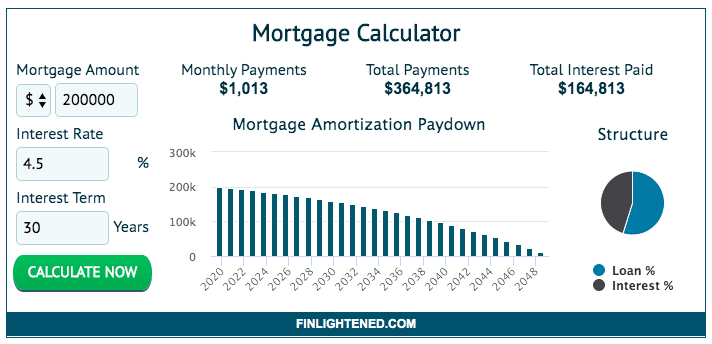

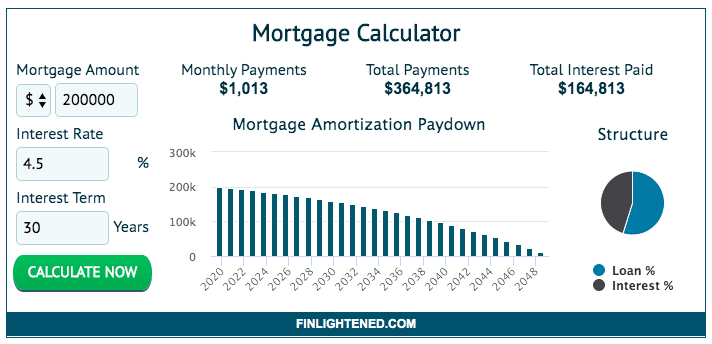

Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay. The monthly payment on a 200000 mortgage is 1348 for a 30 year-loan and 1879 for a 15 year one. The sooner you borrow the more expensive it is as the interest has longer to compound.

The most popular mortgage questions from prospective home buyers and existing homeowners all answered in one convenient place. 100k deposit 500k assumed price 02 x100 for a percentage 20 deposit 100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit Does loan type interest rate and length of home loan affect my borrowing power. Suburb Helps quarterly 100k Investment Report has identified the top 20 investment locations with a lower barrier to entry.

If you need to borrow a lot more than average a jumbo loan or very little you may get a higher interest rate. Please see the Terms and Conditions for more details. CrossCountry Mortgages non-conforming or jumbo loans allow applicants to borrow up to 3 million yet there doesnt seem to be a minimum loan requirement.

SoFi will apply a markup of up to 125 for each crypto transaction. A once off fee charged by banks and credit unions when you have less than 20 deposit. That doesnt mean youll be able to borrow up to 100000.

So borrow as little as you need now and wait as long as you can to do it again. Loans service for up to 60 months. Reverse Mortgage Line of Credit.

Dont borrow all you need in one go. To be able to borrow a 200k mortgage youll require an income of 61525. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage.

How do mortgage lenders work out affordability. The HomeStart charge instead of LMI. Real estate 40 cities that could be poised for a housing crisis.

To qualify for a Home Equity Line of Credit HELOC you need at least 20 equity on your home. SPIRE to Match 100K in Donations to Salvation. 8 Home Improvements That Add Value How to Budget for It.

For example if the interest rate on a Bank of America Advantage Savings account is 100 a 5 5 10 20 rate booster would increase the interest rate to 105 105 110 120. Cost per month per 100k borrowed 10 years repayment product 925 per month 15 years repayment product 650 per month 20 years repayment product 500 per month. The amount you can borrow for a mortgage depends on many variables and income is just one of them.

Manage Your Consumer Loan. Variable APRs apply to purchases balance transfers and convenience checks. LMI for a 400000 property with a 5 deposit would be 14174.

This is an added cost that protects lenders in case borrowers default on their mortgage. Each lender will have its own way of calculating mortgage affordability. Rates are based on product type and creditworthiness so your rate may differ.

Prepared to put down 20 on the home. How quickly can I get a mortgage. You can then express this as a percentage of the appraisal value of the home to compare with the 20.

The credit line option. The APR applicable to cash advance transactions will be a variable cash advance APR up to 2 higher than the APR for purchases. To calculate the equity on your home subtract the amount owed in mortgage loans for the home from the current appraisal value of the home.

According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. Looking for simple ways to score a free 20 dollars right now. This is one of the easier mortgage questions to answer though it can still vary quite.

SPIRE Proud Sponsor of KS95 Clouds Choir for a Cause. 20-year fixed mortgage rates. You can buy a home worth 220000 with a 20000 down payment and a 200000 mortgage.

ZippyLoan connects borrowers to lenders through their network of lenders. Conventional loans require private mortgage insurance if you make less than 20 down payment on the homes purchase price. This interest rate is for illustration only.

Cryptocurrency purchases should not be made with funds drawn from financial products including student loans personal loans mortgage refinancing retirement funds or traditional investments. Below is a table of the rule of thumb cost per 100k borrowed that we use when doing a preliminary French mortgage affordability calculation. 5250 up from 5000.

Make 20 fast. For example if you think you may need 40000 from your home to cover 20 years only take what you need now and wait to take more. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds.

Before you invest 200k into a home youll want to be sure you can afford it.

6 Reasons The Rich Should Pay Off Their Mortgage Early

Getting A Mortgage While On Income Based Repayment Ibr

Struggling To Pay Off Mortgage Faster Any Reason To R Personalfinance

Should You Walk Away From A House And Mortgage

Getting A Mortgage While On Income Based Repayment Ibr

Getting A Mortgage While On Income Based Repayment Ibr

What S The Seasoning Period For Cash Out Refinancing The Fastest Way To Refi Cash Out With Brrrr Bigreia Com

Should I Buy A Home With Cash Or A Loan Quora

Which Formula Dictates That You Pay More Interest At The Beginning Of The Loan Quora

Piti The Cost Of Owning A Home

Request What Were The Terms Of This Loan R Theydidthemath

My 100k Law School Loans From 24 Years Ago Have Been Forgiven R Mildlyinteresting

How To Complete My Home Loan Within Ten Years Quora

Where Can I Get A 20 Thousand Instant Loan Quora

/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example

Mortgage Payment Structure Explained With Example

What Are The Mortgage Loan Interest Rates Quora